Sell My House Fast Kansas City: Accelerate Your Building Sale

Sell My House Fast Kansas City: Accelerate Your Building Sale

Blog Article

Top Strategies for Maximizing Your Earnings When Acquiring and Offering Homes

Market Research and Analysis

By comprehending market patterns, property values, and market variables, genuine estate financiers can recognize profitable chances and minimize possible dangers. Market research study entails taking a look at elements such as supply and need dynamics, economic indications, and regulatory modifications that can affect residential property values.

Furthermore, market analysis enables capitalists to adapt their strategies based on existing market conditions, such as adjusting restoration plans or timing the sale to take full advantage of profits. By staying notified concerning regional market patterns and upcoming growths, capitalists can gain an one-upmanship and make strategic choices that straighten with their financial objectives. Ultimately, detailed marketing research and evaluation serve as the structure for effective real estate transactions, leading capitalists towards lucrative opportunities and ensuring lasting financial success.

Strategic Building Choice

Tactically selecting residential properties is an important element of optimizing earnings in real estate deals. When choosing buildings to sell or purchase, it is vital to take into consideration various aspects that can influence the capacity commercial. Location plays a substantial role in property choice, as properties in desirable areas have a tendency to have greater resale values. Additionally, analyzing the problem of the residential property and prospective restoration or enhancement expenses is important in figuring out the overall earnings of a realty financial investment.

Moreover, comprehending market patterns and forecasts can direct building selection decisions. By assessing market data and forecasting future demand, financiers can identify properties that are likely to value in value in time. It is likewise crucial to think about the target audience for the home, as catering to details demographics or choices can enhance its market charm and prospective success.

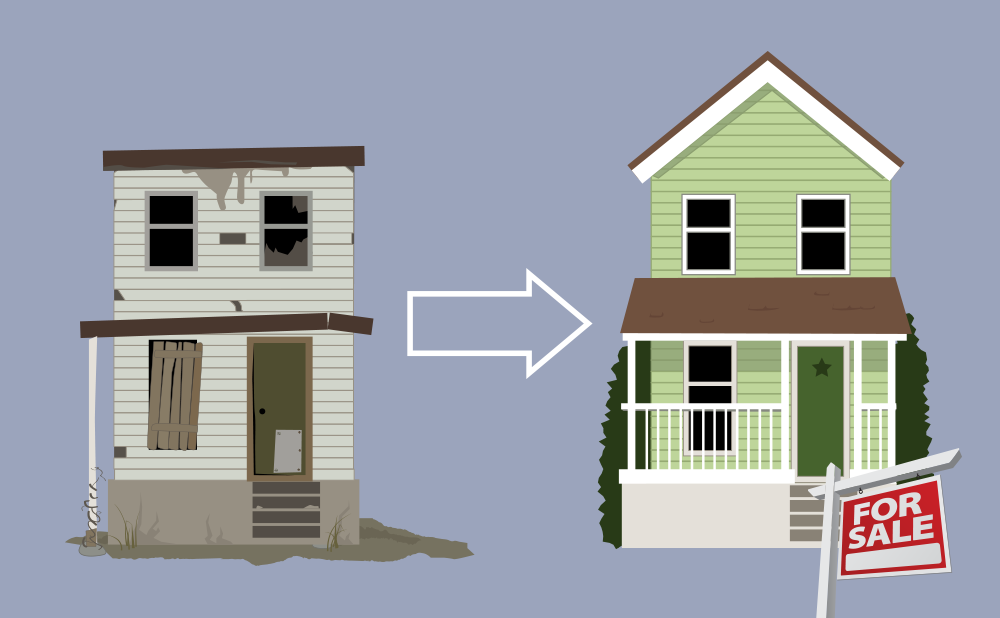

Remodelling and Value-Add Improvements

To improve the general value and allure of a building, applying remodelling and value-add renovations is a calculated approach in genuine estate transactions. Restoring a residential property can substantially increase its market worth, bring in prospective customers or tenants, and bring about a quicker sale at a greater cost factor. When thinking about restorations, it is crucial to concentrate on improvements that provide the very best roi. This includes upgrading shower rooms and cooking areas, enhancing visual allure via landscape design or fresh paint, and dealing with any kind of architectural issues. Value-add enhancements, such as including a deck or completing a cellar, can additionally make the property a lot more preferable to customers.

Reliable Arrangement Strategies

One essential strategy is to constantly do extensive research on the property and the market prior to entering into arrangements. Comprehending the residential or commercial property's value, market fads, and the seller's inspirations can offer you a competitive side throughout arrangements.

One more necessary strategy is to stay tranquil, patient, and confident throughout the settlement process. Being mentally intelligent and preserving a professional demeanor can help develop connection with the various other party and bring about even more effective outcomes. It is likewise important to plainly define your goals and borders prior to entering settlements to stay clear of making hasty decisions under pressure.

In addition, plainly articulating your very own needs and priorities can help direct the negotiation towards a beneficial result. By grasping these settlement techniques, you can enhance your chances of securing profitable bargains in actual estate purchases.

Timing the marketplace for Maximum Revenue

Optimizing profit in real estate transactions requires sharp these details market timing to take advantage of favorable problems and accomplish maximum returns. The realty market is vibrant, affected by different elements such as economic indications, rate of interest, supply and need, and seasonal fads. Comprehending these dynamics is essential for sellers and buyers aiming to make rewarding decisions.

On the other hand, sellers must also time their listings purposefully to bring in the highest possible deals. Evaluating historical information, such as ordinary days on market and asking price, can lead vendors in figuring out the ideal time to note their building. Furthermore, thinking about seasonal trends and neighborhood market conditions can even more enhance the opportunities of costing a premium rate.

Final Thought

To conclude, making the most of profit when dealing houses calls for extensive market research, critical residential property selection, value-add renovations, efficient negotiation strategies, and timing the market suitably. By employing these leading techniques, capitalists can boost their opportunities of accomplishing maximum revenue capacity in the actual estate market.

From thorough market research and sharp evaluation to the art of timing the market for ideal returns, there exist a myriad of approaches that can substantially influence the bottom line of a residential property deal. By recognizing market trends, residential property values, and market aspects, real estate financiers can determine lucrative opportunities and alleviate possible threats.Moreover, market analysis makes it possible for investors Home Page to adapt their methods based on existing market conditions, such as changing improvement strategies or timing the sale to optimize profits. It is also vital to consider the target market for the residential property, as event catering to certain demographics or choices can raise its market appeal and potential earnings.

By carefully preparing and check my blog implementing remodelling and value-add methods, genuine estate financiers can optimize their profits and create buildings that stand out in the competitive market. - sell my house fast kansas city

Report this page